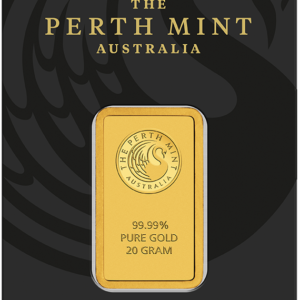

Perth Mint Kangaroo Gold Bar – 20g

$3,326.00 /unit AUD

14 in stock

$5,305.56 /unit

Buy Back Price: $4,872.80

Perth Mint 1oz Lunar Snake Gold Coins made from the finest 99.99% pure gold. These coins feature 2024 date of production.

The coin’s reverse portrays a snake curled among bamboo stems. Included in the design is the Chinese character for ‘snake’, the inscription ‘SNAKE 2025’, and The Perth Mint’s ‘P’ mintmark.

According to Chinese folklore, the emperor ordered a Great Race between all the animals on Earth to determine who should occupy 12 positions in the lunar calendar. Using its guile, the snake finished in sixth place. As a result, those born under the sign of the Chinese Lunar Snake in 2025, 2013, 2001, 1989 and every 12th preceding year are said to inherit the snake’s wisdom, intelligence, independence, and charm.

Celebrating the sixth animal in the ancient lunar zodiac, this prestigious 2025 Year of the Snake coin is struck from 1oz of 99.99% pure gold.

There are many factors that affect the price of Gold. The most important factors include the overall global demand for Gold, interest rates on financial products and services, the value of the United States Dollar (measured via the U.S. index which highlights the value of the U.S. dollar relative to a basket of foreign currencies), the amount of Gold procured by or held within Central Bank reserves, as well as worldwide appetite for holding Gold as a hedge against both rising inflation and currency devaluation.

All of the above factors combine to drive the price of Gold. Ultimately, as the flow of cash into the Gold market increases, the supply of Gold decreases, causing the price of Gold to rise.

GBA offers a large range of gold products from known brands. Listing sizes from 1g Minted Bars to 1 kg Cast bars.

Gold Stackers is proudly an authorised distributor for Perth Mint Australia.

$5,305.56 /unit

20 in stock

The prize of Australia's bullion mints, The Perth Mint is fully owned and controlled by the Western Australia Government and has been around since 1899, even before the creation of the Australia's Federation in 1901. As a former branch of the UK's Royal Mint, it has survived well beyond that of the Sydney and Melbourne Mints which have long since closed, though in their heyday were refining gold during the period of the gold rush and minting a variety of sovereigns for the British Empire. The Perth Mint has been issuing coins even longer than the Royal Australian Mint which similarly produced legal tender in the way of Australian dollar coins.

The Perth Mint's 8,400 sq m (90,000 sq ft) state-of-the-art production facility at 310 Hay Street in East Perth is located right beside the original and iconic building made of limestone. Providing a combination of services to the ever-growing global gold industry including both refining and manufacturing of gold bullion bars and coins and numismatic applications for both local, national and international coin collectors and investors. Australia's legal tender is almost entirely produced and marketed at The Perth Mint and comprises precious metal coins including Platinum Koala Coins, Silver Kookaburra Coins, Swan series coins, Australian Nugget gold coins and a host of other widely acclaimed and eagerly sought after bullion products.

The Perth Mint is responsible for approximately 80% of gold and 30% of silver production in Australia and uses a combination of nationally sourced and internationally sourced precious metals to mint both bars and coins in Australia, which represents a staggering 10% of global production. Annual bullion sales including Platinum, Silver and Gold are close to A$20 billion.